Jul

5

2013

The peer-to-peer rental model is fragile. If you lent your ladder to someone and didn’t get it back, would you ever use the sharing economy again?

P2P startups live or die by good and bad participants.

Today, StreetLend announces two innovative new features to help build trust in P2P rental:

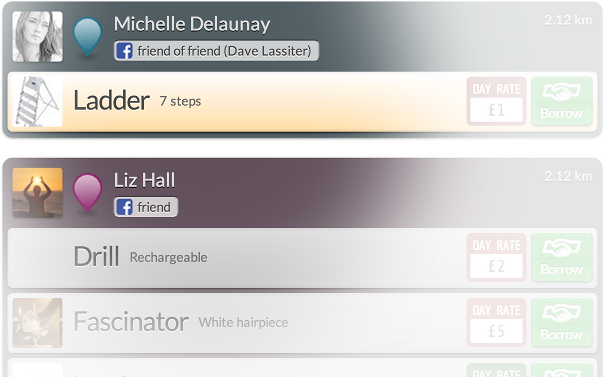

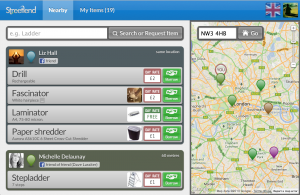

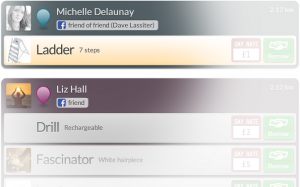

Your friends are ideal borrowers and lenders. They value your friendship, so will look after your things. But do you have enough friends to find items to borrow nearby? The average Facebook user has 141 friends, and we can’t expect them all to become P2P lenders. However, factoring in their friends gives a pool of ~20,000 people (ignoring interconnectivity for now). Now there’s a real chance of finding nearby items offered by people we trust. When a user logs in with Facebook, StreetLend automatically identifies relationships in two degrees of separation:

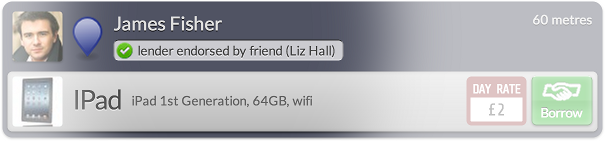

Neighbours outside your friend circle are still shown on StreetLend, and the choice is yours whether to deal with them. They won’t be untrusted forever. StreetLend now features an endorsement system that adds neighbours into your trusted circle after a successful lend.

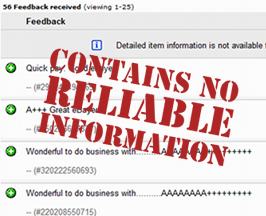

Ever seen the escalating battle of A’s and +’s in eBay reviews? Are they compensating for something? How valuable are reviews written by strangers? And what’s to stop people reviewing themselves?

Endorsements of lenders and borrowers are more believable when they come from your own circle of friends.

After a successful StreetLend transaction, the lender endorses the borrower with a simple click (and vice versa). Lender and borrower become connected, like friends, in StreetLend’s trust network. What started as 20,000 trusted people now grows further with each transaction, as StreetLend shares your endorsed connections with your friends:

With these new capabilities, StreetLend sets the benchmark for trust in the sharing economy. Two degrees of separation reaches a large network of trusted people, and we can finally trust online endorsements because they come from real-world friends.

Sign up with just a couple of clicks and put your unused items to work today: http://www.streetlend.com/

StreetLend has an advanced trust system that highlights your friends, their friends, and StreetLenders they’ve endorsed.

StreetLend has an advanced trust system that highlights your friends, their friends, and StreetLenders they’ve endorsed.